An outdated form

The underwriting philosophies at the heart of annuities decisions in the UK are based on the Retirement Health Form. This form was developed by annuity providers and pulls together the questions customers must answer about their health and lifestyle.

The form provides many benefits – chiefly that, rather than having to complete multiple forms for multiple providers, customers fill out just one. But because the form is a unified creation of all providers, amending it is difficult: Any change requires unanimity.

The result is an extremely outdated form.

An old form is like lower-octane gasoline in the high-performance engine that is modern-day automated underwriting. Asking questions that no longer apply in the decision-making process or that behavioral science has discovered could be asked in a way to elicit more accurate answers is leading to less-than-optimal determinations.

It also means many people are receiving less in their annuity payouts than they could.

People tend to downplay their medical history. With annuities, such under-disclosure leads providers to offer lower annual payments because the longevity risk is greater among people who declare themselves healthy. Even though there are financial incentives with annuities to appear unhealthy, there are psychological incentives to reporting good health, such as avoiding embarrassment and the sense of self-esteem.

Because of that, many are missing out on money that would help provide for a better retirement simply because some of the questions on an outdated form are being posed in a way that does not promote accurate disclosure.

A timely investment

Amid the uncertainty following the decision to revamp the pension system, RGA made a substantial investment in the technology that underpins annuity underwriting. The push to automate some of the process started with a rules engine that assisted in making annuity decisions based on a small number of high-prevalence conditions.

The idea was that once the novelty of pension freedoms played out, a resurgence in the annuity market would follow, and RGA wanted to be prepared to be a key player and advocate for clients when that happened.

Then, in early 2022, with annuities showing some signs of life, RGA launched a new annuity technologies solution called Unity. No longer were decisions limited by that handful of high-prevalence conditions. Unity allowed for consideration of a greatly expanded range of medical disclosures and factored in a variety of socio-economic factors known to have a bearing on life expectancy, such as marital status.

The result?

RGA soon was processing more than 1 million quotes each month based on more than 70 annuity philosophies covering everything from asthma to metastatic terminal cancer. Results were returned to client systems in, on average, less than 2.5 seconds.

The limiting factor was and remains the outdated form. The percentage of customers being offered a standard annuity without a medical enhancement that would boost their payments still does not reflect population data about what that percentage should be. The result: Under-disclosure is costing them money.

RGA’s Behavioral Science team has dived deep into the questions on this form and found that just a few subtle tweaks could lead to better decisions that benefit retirees. Here’s an example.

An alcohol question

The current application question about alcohol consumption simply asks, “How many units of alcohol do you drink weekly?” Although the form offers guidance on what is meant by a unit, providing an educated answer still requires some element of manual figuring. This takes time and increases the load on customers’ mental capacity.

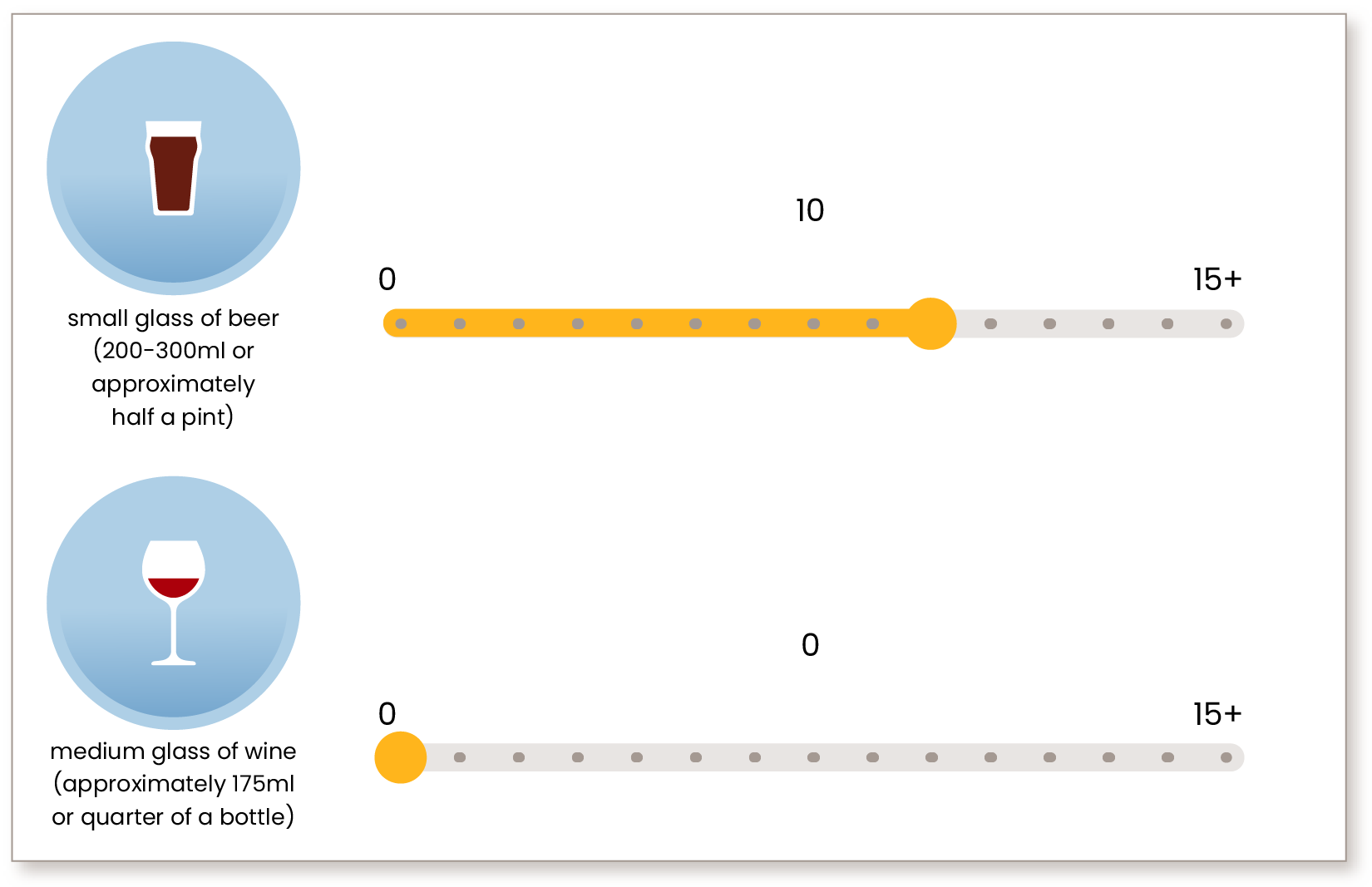

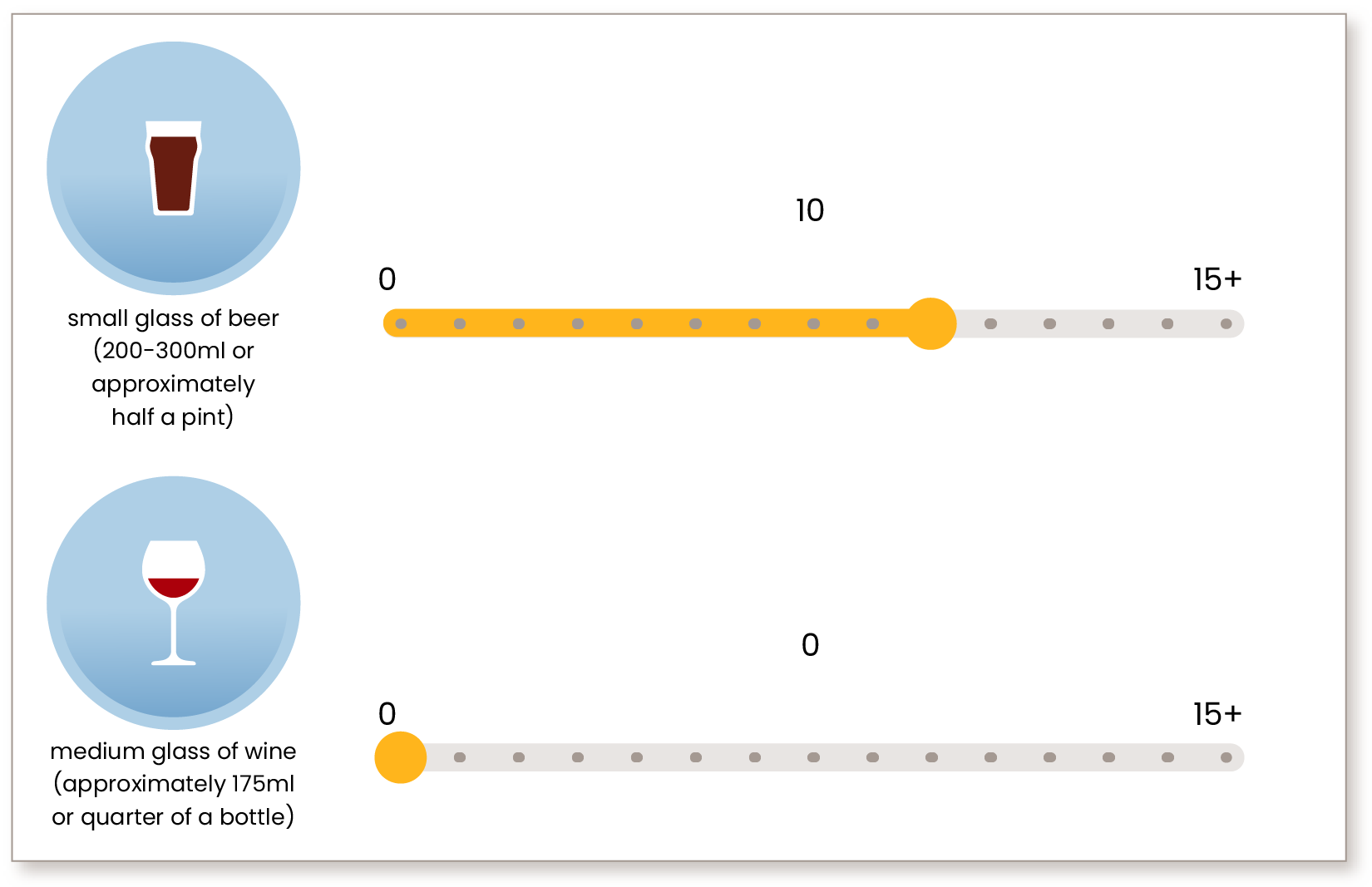

In a randomized and controlled trial involving more than 20,000 participants, RGA’s Behavioral Science team presented alternatives to this question. The goal was to see if disclosures significantly changed if the question listed different types of alcohol or offered visual aids. By presenting the question with visuals and a free-text box, the average number of units disclosed increased 1.5 times compared to the current question. Furthermore, by replacing the free-text box with a slider that further prompted participants' understanding and memory (See Figure 1, below), disclosures on average increased 2.5 times from the current question.

The scale, using high but realistic end-points, also de-stigmatizes higher alcohol intake by framing what is seen as normal, making people feel more comfortable to report higher intake amounts.

This change is significant and, if implemented, could result in a substantial increase in annuity payments for many.

Figure 1: Using behavioral science to elicit more accurate responses.

A positive message

Yes, this would cost providers more on a per-annuity/customer basis. But the difference would be more than made up in the volume of annuities issued as more people realize they qualify for higher payments and greater security through guaranteed annual income.

Simply put, the ability to use advanced technology such as Unity and an updated form to find retirees more money to support their golden years is a great marketing message for our industry at this moment. But even more than that, we all truly want the best outcome for our customers. That makes this the right thing to do.

Getting there requires unity among providers. RGA stands ready to play an active role in bringing the industry together to conduct a complete review of the form with a desire to develop a quicker and easier application journey.

The result will be happier customers and a society better protected as they proceed through their retirement.

Next: Dive deeper into annuities. Contact the UK financial solutions team today.